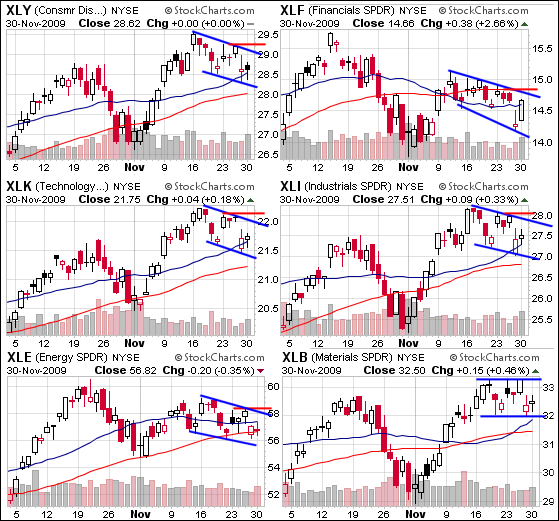

ST downtrends in the sector SPDRs

On the CandleGlance charts, the four offensive sectors sport falling consolidations over the last 2-3 weeks. After recording higher highs in mid November, the Consumer Discretionary SPDR (XLY), Technology SPDR (XLK) and Industrials SPDR (XLI) pulled back with falling flags over the last two weeks. Technically, we could call the short-term trend down with these falling flags. The Financials SPDR (XLF) formed a lower high in mid November and also declined the last 2-3 weeks. Each chart shows key resistance in red. A move above resistance would fill Friday's gap and reverse the 2-3 week slide.

The last two charts show the Energy SPDR (XLE) and the Materials SPDR (XLB). XLE has been lagging the broader market with a lower high in November. Nevertheless, XLE sports a falling consolidation over the last two weeks. A break above resistance here would be bullish for XLE. With a flat consolidation over the last two weeks, XLB is holding up the best of the six. The ETF is consolidating near support at 32. Look for a breakout to signal a continuation of the November advance. Charting Note: I copied the chart images to another program to make the annotations.